The destruction from Hurricane Sandy will negatively impact fourth quarter economic growth. Most of us have heard by now that not addressing the fiscal cliff will throw the United States back into recession. The CBO has warned and warned again. Similar to the trifecta of three separate weather events combining to create Frankenstorm, we have economic and political events colliding to do the same.

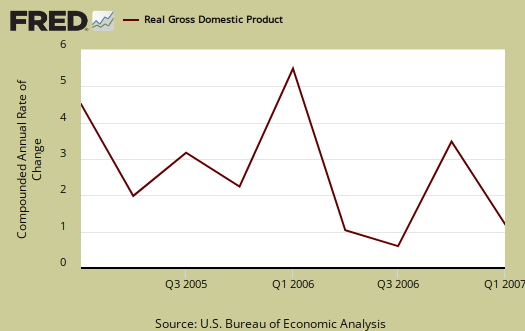

Economic forecasters are tallying up the damage from Hurricane Sandy and currently estimates are coming in at $50 billion. We expect Hurricane Sandy economic impact figures to rise. By comparison, Hurricane Katrina's economic devastation was eventually estimated to be $250 billion, with property damage alone estimated at $108 billion. Katrina hit on August 29, 2005. Q3 is July through September. Below is GDP for the time around the coming of Katrina.

National real GDP went from 3.2% to 2.1% from Q3 to Q4 2005. GDP does vary normally between quarters and there are many other factors which contribute to economic growth. Yet, the gulf states contribution to national GDP are minimal. Louisiana and Mississippi together are only 2.2% of national GDP. The eastern seaboard's economic contributions, on the other hand, are substantial. New York alone was 7.7% of national GDP in 2010 and New Jersey, 3.4%. Below is a graph of the state of Louisiana's GDP, annually. We see a dramatic growth rate drop after Katrina hit.

It is estimated that Katrina reduced Q3 and Q4 real national GDP by 0.7 and 0.5 percentage points respectively.

Yet as regions recover all sorts of stimulative economic activity occurs. Government spending increases due to benefits, emergency payouts, grants and other spending related to recovery from the Hurricane's damage. Construction increases and workers are hired to rebuild. After Katrina, the increased government spending, rebuilding and other recovery activity actually raised real GDP in by 0.5 percentage points in the first half of 2006.

Since the Eastern seaboard is such a large percentage of the national economy, we should expect Hurricane Sandy to negatively impact Q4 GDP but those effects should be over in 2013. We should also see an increase in economic growth in 2013 as rebuilding as well as government spending should jump up. If the economic activity losses that affect GDP are $50 billion, we can take the average nominal GDP of the last year and remove annualization to get about $3.9 trillion average in quarterly GDP. This gives a reduction of raw Q4 GDP by 1.3 percentage points, or 0.5 percentage points annualized. Sandy will show up in 4th quarter GDP figures and the hurricane will impact economic growth, abet temporarily. Q1 and Q2 of 2013 on the other hand, should give an economic boost, highly dependent on government spending and rebuilding.

Why then the title the perfect economic storm if GDP will be impacted yet that economic contraction is temporary? After all, the reconstruction should give a stimulative boost to the first half of 2013. The reason is the fiscal cliff and the third element in the economic storm trifecta, Obama's grand bargain, being negotiated by Congress in secret, under the guise of addressing the fiscal cliff and being lobbied for by CEOs.

The CBO projects if Congress does not act to stop the across the board budget cuts, known as the fiscal cliff, America will sink into recession. The CBO has been sounding the alarm bell as has the Federal Reserve on the fiscal cliff. Current law's sharp deficit cuts are projected to cause a -0.5% GDP contraction from Q4 2012 to Q4 2013 and increase the unemployment rate by 1.1% by Q4 2013. This is a 5.1% deficit reduction as a percentage of GDP. The sharp cuts will throw the U.S. into a recession, defined as two consecutive quarters of negative GDP growth. Below are the CBO slides illustrating what will happen.

The gathering storm isn't addressing the fiscal cliff in and of itself. It is what this administration and Congress may do in the lame duck Congressional session after the election under the guise of stopping the fiscal cliff. There is talk of cutting social security and Medicare. President Obama mentioned his deficit cutting grand bargain in this Des Moines Register interview.

I am absolutely confident that we can get what is the equivalent of the grand bargain that essentially I've been offering to the Republicans for a very long time, which is $2.50 worth of cuts for every dollar in spending, and work to reduce the costs of our health care programs.

And we can easily meet -- "easily" is the wrong word -- we can credibly meet the target that the Bowles-Simpson Commission established of $4 trillion in deficit reduction, and even more in the out-years, and we can stabilize our deficit-to-GDP ratio in a way that is really going to be a good foundation for long-term growth. Now, once we get that done, that takes a huge piece of business off the table.

Bowles-Simpson deficit reduction recommendations call for cuts to social security and Medicare. One Medicare cut is to cap payouts and to social security are recommendations to raise the payroll tax. Other proposed cuts to social security are to remove the cost of living adjustments and raise the age when one can receive benefits. There is no talk of raising the limit on maximum taxable earnings for FICA taxes.

Bill Black has been warning of Obama's grand bargain to reduce social security benefits by claiming to deal with the fiscal cliff.

Robert Kuttner has written much of the column I intended to write on this subject, so I will point you to his excellent column and add a few thoughts.

Kuttner wrote to warn that Obama intends to seek a “grand bargain” causing the U.S. to adopt the type of austerity program that threw the Eurozone back into a gratuitous recession.

Worse, Obama intends to begin to unravel the safety net (Social Security, Medicare, and Medicaid) to convince the Republicans to enter into this Faustian bargain.

Way back in the 2008 primaries, we warned Obama would partially privatize social security, a long desired Wall Street objective.

There are other critical programs on the chopping block, all propping up the poor and lower income Americans which, lest we forget, is most of America. The earned income tax credit, the child tax credit and the college tuition tax credit are all set to expire. The home mortgage interest deduction is also on the table to be cut.

The grand bargain, this supposed deal is all about letting the top income Bush tax cuts expire in exchange for starting the destruction of America's social safety nets. The thing is, Obama had that chance to let the Bush tax cuts expire earlier and he caved and let them be extended instead. The Congress tackling the fiscal cliff is the same Congress who would manufacture a debt ceiling crisis, resulting in a of the credit downgrade of the United States.

This is why we project the perfect economic storm is bearing down on the American people. We know hurricane Sandy will negatively impact economic growth. We know the fiscal cliff will cause an economic contraction severe enough to throw the United States into recession. We also know we have a crazy and very corrupt Congress, corporate lobbyists everywhere and a so called Democratic President willing to throw most Americans under the bus through disguised austerity measures. If social security and Medicare are slashed, this will jolt America into austerity, causing permanent economic contractions similar to Greece, Spain and all other nations in hock up to their eyeballs in order to pay back investors who traded in their debt.

Comments

Hurricane Sandy's effect on GDP, 0.5 percentage points

Today the New York Times reported Hurricane Sandy would cost $50 billion in economic activity losses (not just property), thus affecting GDP and "some economists estimate" Q4 GDP will be reduced by 0.5 percentage points (annualized).

The sad aspect to this is we said these figures and showed how to calculate the effect on GDP over 48 hours ago.

take the over on that $50B...

few realize how large the storm was; even before the storm came ashore at cape may, new jersey, truck traffic was banned from the ohio turnpike and storm warnings went up on lake michigan for 20 foot waves...& at it's peak, the precipitation circulation around the storm extended from nova scotia to wisconsin and from hudson bay to south carolina...portions of NC 12, the highway running the length of the outer banks, were also wiped out...

Sandy infrastructure power grid economic costs

Considering the sustained wind speed really wasn't a hurricane when Sandy hit the shore (current estimates are 75 mph sustained, 1 mph above the tropical storm category), it's pretty obvious the Eastern seaboard is woefully unprepared for a natural disaster, major weather event.

The gulf states get 75 mph sustained winds often and never talked about is the Pacific Northwest, where it's guaranteed to have at least one winter storm with 75 mph sustained winds at some point along the coast.

Time matters too, and Sandy "stayed" on top of the area longer than a Pacific Northwest storm typically does.

But bottom line, the death, destruction, gas lines, transit shut down and the biggest, the fact most of NJ is still without power shows the Eastern seaboard's design didn't think about hurricane force winds.

Lord help them if a real hurricane hits, say 110 mph sustained winds over a large area that also stalls out.

At the time this article was written, we were the only site giving a rough estimate if the economic activity losses hit $50 billion. You can assume if they go higher and the longer economic activity is disrupted, plus the more insurance companies screw homeowners and businesses with this phony "new deductible", the more the real losses will increase.

As they come in, I'll put at least in a comment how badly Q4 GDP will be impacted, right now I'd say at least half a percentage point on real Q4 GDP, (that's annualized, as the BEA presents the change in real GDP in the headlines).

The surprise is Atlantic City is up and running again and that is major revenues for the area, business activity, so we'll just have to see.

There is property damage which is one thing and then economic activity, so things like oil shut downs, retail sales, consumer spending, exports being shipped out, imports being shipped in (negative), inventories being added to by businesses, investment purchases... that's the economic activity that is affected in terms of growth.

Property losses indirectly affect other things.

Fiscal Cliff

Just a reminder we've been outlining the consequences of the Fiscal cliff for months and magically the press, all at once woke up with "dire reports".

So, I believe we're in for what we predicted, cuts to the social safety net under the guise of a "bargain" to avert the fiscal cliff.

We'll update as it happens.

New York Seeks $30 billion in Federal Aid

It's looking possible that our estimate of $50 billion in economic activity losses and this is for fourth quarter GDP, it's not transfers due to insurance payouts, losses, it would be elements which go into making up national GDP, is a low ball estimate. After some more dust settles and we get better estimates we'll try to update how badly this will impact Q4 GDP. For now we can say for sure it will shave off half a percentage point. Sandy is coming in as the second most expensive storm. Katrina is number one which is why we used Katrina estimates in this article.

initial claims 439,000, Nov. 10

This would be from Nov. 3 to Nov. 10 initial claims. Hurricane Sandy made landfall on October 29th. I expect initial claims to be higher next week as the fall out from Sandy continues. Next week we will be able to better see which states lost jobs the most. We have some from Nov. 3 which shows NJ, OH, PA having significant increases but these are not seasonally adjusted, so for now, assume this is due to the Hurricane.

But talking heads say this will be good for rebuilding jobs

No matter what, someone will spin it. Higher numbers are result of hurricane, but to spin it positively, they'll claim this is somehow good because so many people will be needed to rebuild houses, piers, electric grid, sidewalks, roads, and bridges, seawalls, insurance inspectors, and so on. Everything, no matter what, is always spun. Every single day it's spun is another day we get no real reprieve. I thought Day 1 after the election someone somewhere would just unleash some jobs ass-kicking program/ideas. But no, all the election "uncertainty" is done and nothing, nothing is revealed except the same old news about fiscal cliff.

Honestly, things don't change real soon, those with the ability will just get a small plot of land and feed themselves + family. If they want to trade, fine, small items, crafts. We are going Amish, is it bad, is it good, who knows, but it's becoming the only viable way of surviving apparently because the ability to go to school through college, earn a decent wage in a 9-5 job, and survive until a survivable retirement are absolutely becoming a pipe dream due to those in charge. That's not hyperbole, that's the state of the developed world. EU probably worse, South Korea and Asia are also suffering this issue. South Korean small businesses are going under, South Korea leads Asia in suicides, and big business is getting richer and bigger. Japan, same problems. This is a global plague. China will suffer too, but it's a few years until that happens. There are no idea men at the top, the top folks are loving this. The ideas are at the bottom of the social pyramids, but they are at the bottom for a reason (top doesn't want to hear it).

talking heads

The only information I'd like to know from talking heads is how in God's name they earn 7 figures spewing nonsense 24/7. They are raking it in and facts, statistics be damned.