Quantitative Easing rumors are now spreading like wildfire. Speculators have already grabbed one commodity, tin.

Quantitative Easing rumors are now spreading like wildfire. Speculators have already grabbed one commodity, tin.

Tin climbed the most in almost four months in London as prospects of low U.S. interest rates at least until 2014 boosted speculation of increased demand for the metal used in mobile phones, plasma screens and cars.

Gold bugs are also going nuts and most commodities have jumped in prices, almost overnight.

There was a one two three punch by the Federal Reserve. First the FOMC announced uber-low interest rates until 2014.

The Committee expects to maintain a highly accommodative stance for monetary policy. In particular, the Committee decided today to keep the target range for the federal funds rate at 0 to 1/4 percent and currently anticipates that economic conditions--including low rates of resource utilization and a subdued outlook for inflation over the medium run--are likely to warrant exceptionally low levels for the federal funds rate at least through late 2014.

Additionally the Fed decided to continue operation Twist.

The Committee also decided to continue its program to extend the average maturity of its holdings of securities as announced in September. The Committee is maintaining its existing policies of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction. The Committee will regularly review the size and composition of its securities holdings and is prepared to adjust those holdings as appropriate to promote a stronger economic recovery in a context of price stability.

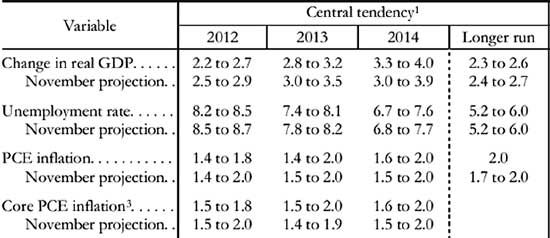

Punch Two: GDP was revised down. Below is the summary chart provided by the Fed on GDP, inflation and unemployment.

The Federal Reserve also has a target inflation rate of 2% per year. Since core CPI has been low, many believe this is the gateway to more quantitative easing.

Punch Three, Knockout: In a press conference, Federal Reserve Chair Ben Bernanke responded to a question about more quantitative easing and said:

That's something as an option that's certainly on the table.

Like Pavlovian dogs, few heard there were conditions for QE3:

If inflation is going to remain below target for an extended period and unemployment progress is very slow, then I think your implicit question is right. There is a case for additional policy action and we'll--you know, we want to continue to observe the situation but we're certainly prepared to look for different ways to

provide support to the economy if in fact we have this unsatisfactory situation.

Speculative and commodity traders are now going crazy, buying commodities futures in anticipation of the great QE3.

Think about it. Traders are praying for even lower GDP, higher unemployment and deflation. Will QE3 happen? First, Q4 GDP is projected to come in at 3.0%, and second, the conditions upon which the Fed will enact more quantitative easing haven't happened yet. Finally there is political reality where many are already calling to end the Fed and to stop devaluing the U.S. dollar. Then there is that minor detail, quantitative easing doesn't do jack for the real problems, low income and wages for America's workers, middle class. Surprise, most of America are not speculative commodities traders.

One reality check comes from ZeroHedge and we heartily agree. The Fed is moving markets by hints versus actually doing anything because words and hints move markets and get the job done. Remember quantitative easing is not politically popular.

If you’re counting on the Fed propping the market up throughout 2012 as it did in 2011, you may be in for a rude awakening in the coming months. Every day that we get closer to the 2012 Presidential election, the bar for more QE goes higher and higher. Truly unless we get some kind of major Crisis, the Fed won’t be doing much of anything.

Finally if quantitative easing worked so well on a macro economic level, where are the jobs and the improved middle class income? About the only thing quantitative easing moves are food prices and Wall Street traders dancing on their feet at the prospect of more profit.

Some say it's even worst than that, quantitative easing is killing demand:

Warren Mosler recently ran a very succinct account of why the Fed/Bank of England’s easy monetary policies – that is, the combination of Quantitative Easing and their Zero Interest Rate Programs – might actually be killing demand in the economy.

Mosler’s argument runs something like this: when interest rates hit the floor they suck interest income payments that might flow to rentiers and savers. And no, we’re not just talking about Johnny Moneybags refusing to buy his daughter a new Prada handbag (which, say what you will, creates job opportunities). We’re also talking about regular savers and, as the Fed recently noted, pension funds seeing their income fall – not to mention certain industries, like insurance, finding their profits lowered (and hence their premiums raised?).

Oh well, at least Wall Street is happy.

Comments

QE3 Likely Priced Into Commoditites Already

Not really. Commodities have been moving in tandem with the stock market. When stocks tank, so will commodities. It's the same hot money going into both.

Forget the supposed link of metals to the 'fear factor.' In today's world that is only a small part of price fluctuations.

Then there's China, which when it tanks will smack down metals by at least 30%. QE3 has been talked about, and thus priced in for quite some time now.

What should you buy, now? Clothes, food, electronics, booze etc. Keep your cash on hold till it can be put to good use in a market crash.

If the cash becomes worthless? That's what's the booze is for!

priced in and Facebook

There were sharp upward movements when the Fed announced "zero interest until 2014! We finance" plus another after the press conference. Yeah, I agree, demand rules all though so it's more crazy speculators.

To wit, Facebook IPO looks like it's going to sucker in millions. Don't these people know an IPO spikes out and then drops after, that all of the institutional investors and such who have pre-IPO stock are the winners and they are guaranteed to lose?

How in God's name can a company be worth so much when it's a glorified layer on top of the Internet.

Anyway, I fear a host of people buying the hype will lose their shirts.