The Producer Price Index, or wholesale inflation, increased 0.4% in February 2012 for finished goods. Energy alone increased 1.3% with gas jumping 4.3%. Core PPI, which is finished goods minus food and energy, increased 0.2% and is the 3rd month in a row for an increase. Food alone declined -0.1%. While this is wholesale, retail shoppers beware, price increases are usually passed onto consumers. PPI is a Federal Reserve watch number for signs of future inflation. Intermediate goods prices increased 0.7% and crude or raw materials prices increased 0.4%.

PPI is reported by stages of processing of materials, finished, intermediate and crude. Finished are commodities ready for final sale, intermediate are partially finished, such as lumber and cotton and crude are products entering the market for the first time, such as raw grain and crude oil.

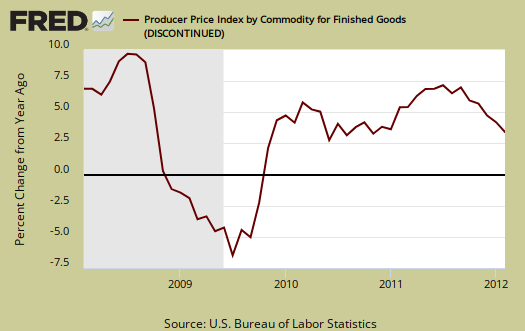

Unadjusted, finished goods have increased 3.3% for the last 12 months, which is as low as August 2010's 3.3% year-over-year increase. Below is the wholesale finished goods PPI percent change for the year.

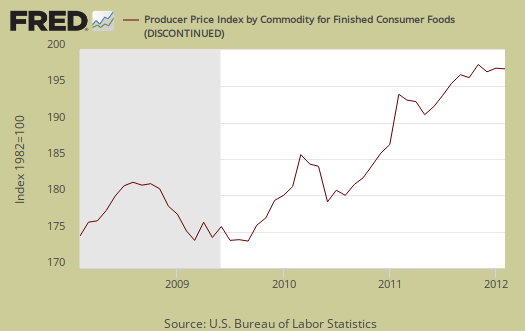

The decline in food prices were mainly due to a -2.8% drop in dairy products. Fresh vegetables declined -7.3%. Chickens increased 5.0% while eggs dropped -4.4%.

Below are Core PPI or finished goods minus food and energy, which increased 0.2% for February 2012. The reason finished core increased is drugs. Pharmaceutical preparations increased 0.6% in February.

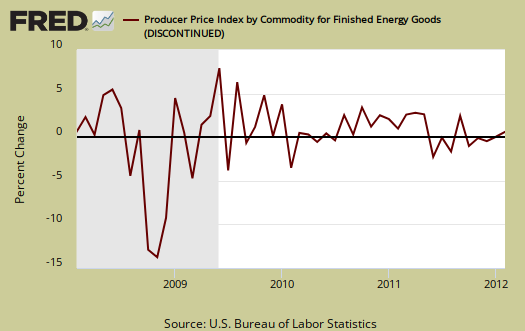

Below is the monthly percentage change of finished energy only, to show the spike in prices. Residential gas decreased -2.8%, home heating oil increased 5.3%, electricity, -0.1% and gasoline, 4.3% for February. Electricity increased 0.6%.

Crude PPI increased +0.4% in February 2012 and is up 0.4% for the last three months. Crude energy increased 0.3% while foods increased 0.6%. Crude core or crude stuff minus food and energy, decreased -0.3, with a -6.4% drop in scrap steel and lower corn feed prices.

For intermediate wholesale goods we had a 0.7% increase, with energy increasing 0.3%. Diesel fuel alone increased 4.1%.

Intermediate core jumped 1.0% in February. From the report:

Sixty percent of this increase can be traced to the index for basic organic chemicals, which jumped 6.4 percent. Higher prices for nonferrous mill shapes and prepared paint also contributed to the advance in the intermediate core index.

Below is the indexed price change for all commodities. Commodities are not limited to what comes from inside the United States.

PPI also has special indexes which measure services and their margins. From the report:

Trade industries: The Producer Price Index for the net output of total trade industries edged down 0.1 percent in February after no change in the prior month. (Trade indexes measure changes in margins received by wholesalers and retailers.) Leading the February decline was an 11.7-percent decrease in margins received by discount department stores. Lower margins received by merchant wholesalers of durable goods and by electronic shopping and mail-order houses also contributed significantly to the decrease in the total trade industries index.

Transportation and warehousing industries: The Producer Price Index for the net output of transportation and warehousing industries moved up 0.4 percent in February, the third consecutive increase. Almost half of the February gain can be attributed to a 2.3-percent advance in prices received by the U.S. Postal Service. Higher prices received for long-distance general freight trucking and by line-haul railroads also were factors in the February increase in the transportation and warehousing industries index.

Traditional service industries: The Producer Price Index for the net output of total traditional service industries rose 0.2 percent in February subsequent to a 0.4-percent advance a month earlier. Accounting for thirty percent of the February increase, prices received by portfolio managers climbed 2.2 percent. Higher prices received by investment bankers and securities dealers and by non-casino hotels and motels also contributed to the February increase in the total traditional service industries index.

This all implies these wholesale price increases will be passed onto consumers through retail sales price increases later down the pike.

Here is the BLS website for more details on the Producer Price Index. They list individual items and special indexes.

Recent comments