4th consecutive monthly loss of private sector jobs in March; virtually ALL new private jobs yr/yr are in bars and restaurants.

Today’s BLS report shows the economy lost -80,000 jobs in March as the private sector lost another -98,000 while 18,000 more government jobs were added – almost entirely in state/local governments for public schools and prisons. This is the 4th consecutive monthly loss of private sector jobs that now total -300,000 since November.

Over the past 12 months the private sector added just 292,000 jobs and 188,000 of these were in restaurants and bars – “food services and eating establishments.” As has been the unique pattern for the past seven years, over the past year the private sector added “Non-supervisory/production” jobs (608,000) while eliminating (-406,000) supervisory/non-production jobs.

Over the past 12 months the private sector added another 363,000 jobs to the run-away, private health care bureaucracies – that is, except for private Health Care bureaucracies, the US private sector lost jobs over the past year.

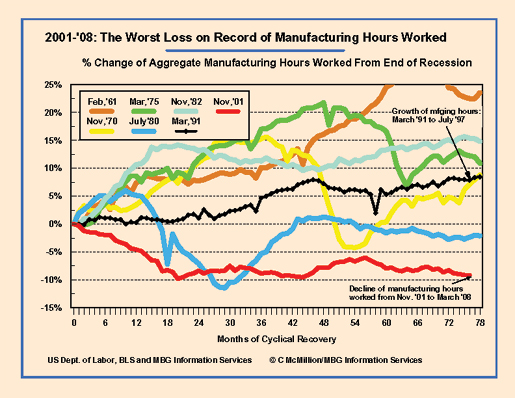

Private health care added another 23,000 jobs in March as did food services/eating places. Virtually every other industry had stagnant or declining job totals in March as the debt crisis is now affecting even those jobs that do not face imports or easy outsourcing. Along with -48,000 jobs lost in Manufacturing in March, Construction lost -51,000 jobs, Wholesale and Retail lost jobs, Information and Finance lost jobs, and – with a sharp drop in temporary and employment services – Business and Professional Services lost jobs in March. (my industry-by-industry jobs table is attached)

Today’s report contains indications of acceptance on the part of many employers that the current recession could be long and severe. That is because the paid work-week was extended in almost every industry even as those industries were cutting jobs. The average weekly hours (including overtime) paid in almost every Manufacturing industry increased even as almost every industry was cutting jobs. The same is true throughout the service sectors indicating that they expect further slowing ahead.

So even with fewer jobs, the total number of aggregate paid hours worked rose by almost 0.2% in March. Furthermore, since hourly wages (before inflation) rose by almost 0.3% in March, total nominal wage income seems to have risen by about 0.5% and, because of reduced jobs, weekly wages per job rose almost 0.6%. It is important to appreciate that, while those that lost their jobs in March face hardships, overall wage income rose in March. The BLS will not report on consumer inflation until April 16th but the purchasing power of the average weekly wage almost certainly rose 0.2% to 0.4% in March and total real wage income likely also increased. With all the bad economic news and denial, this small – likely temporary – increase in real wages comes at a particularly important time for most households and for the economy.

| Attachment | Size |

|---|---|

| 26.24 KB |

Recent comments