The Federal Reserve's consumer credit report for July 2012 shows a 1.5% annualized monthly increase in consumer credit. Revolving credit declined, -6.75%, and nonrevolving credit increased 1.0%. The Credit Kraken went back into it's cave.

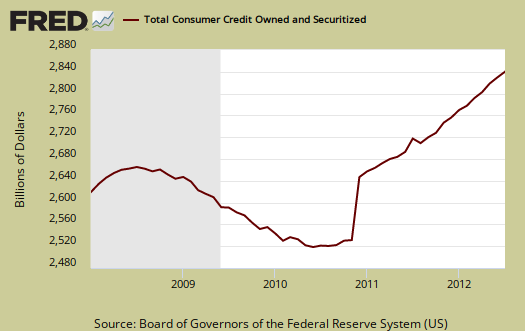

Overall consumer credit decreased -$3.276 billion dollars to $2.705 trillion, seasonally adjusted. Revolving credit decreased -$4.823 billion while non-revolving increased $1.548 billion. Revolving credit are things like credit cards and non-revolving are things like auto loans and student loans. Mortgages, home equity loans and other loans associated with real estate are not included in this report.

June's figures were revised to show a much larger increase in consumer credit, which increased 5.3% from May, but revolving credit declined -4.5% while nonrevolving increased 9.8%, and once again the culprit appears to be student loans. May was also revised with a 8.7% increase overall in consumer credit, with revolving credit jumping 13.8% and nonrevolving increasing 6.3%.

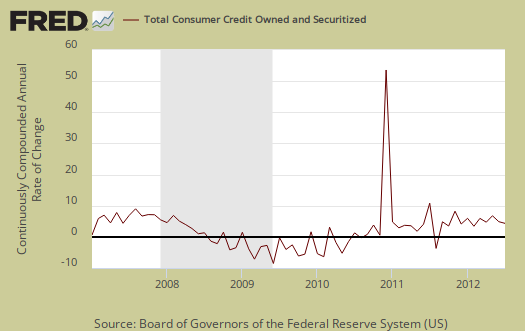

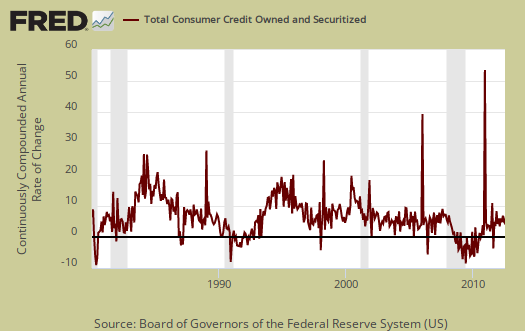

The report gives percent changes in simple annualized rates, also known as a continuously compounded annualized rate of change. Below is the graph of the monthly annualized percentage changes in consumer credit going back to 1980.

From the above graph we can see outstanding consumer credit drops correlate to recessions. The consumer credit report does not include charge offs and delinquencies. For July, Moody's reports credit card charge offs increased but delinquencies are down.

Securitized credit card charge-offs in the US increased to 4.56% in July from 4.27% in June, according to Moody's Credit Card Indices. One-time technical factors explain the rise, says Moody's, and the charge-off rate index will resume its downward trajectory next month, reaching about 4% by the end of the year.

A clear indication that charge-offs will continue to decline is the further drop in the delinquency rate in July, which reached a new low in the month of 2.36%, down from 2.40% the previous month.

Below is total consumer credit.

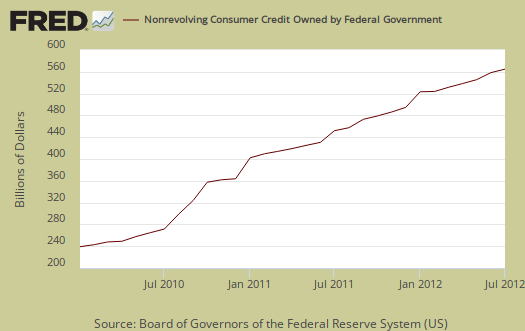

Student loans continue to roar. Federal government nonrevolving credit, which includes student loans increased another $1.1 billion to $471.8 billion, seasonally adjusted. The federal government started making 100% of guaranteed student loans in July 2010. People went more into debt, clearly, to pay for the soaring, absurdly high, educational costs. Below is the not seasonally adjusted ballooning nonrevolving credit held by the Federal Government.

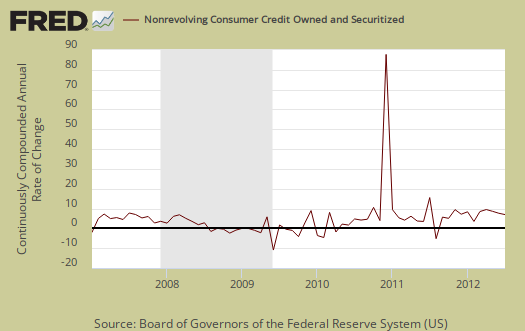

Below is non-revolving credit, seasonally adjusted, annualized percentage change.

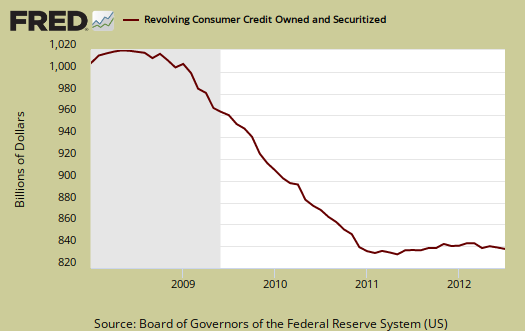

Revolving credit, which is mainly credit cards, has declined for two months now and is to April 2012 levels (not 2011 levels as some in the press reported). Charge offs are not included in this report. These numbers are seasonally adjusted. Interest rates for credit cards with a balance was 12.76% in May for commercial banks. Think about that and how the Federal Funds effective rate is essentially zero.

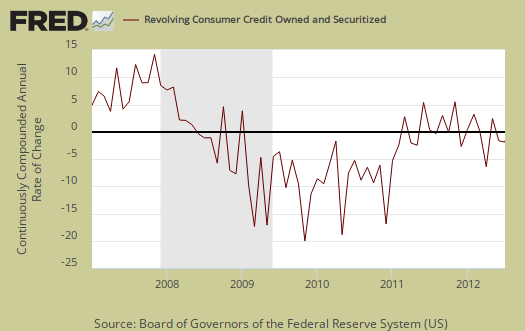

Below is the monthly revolving consumer credit annualized percentage change.

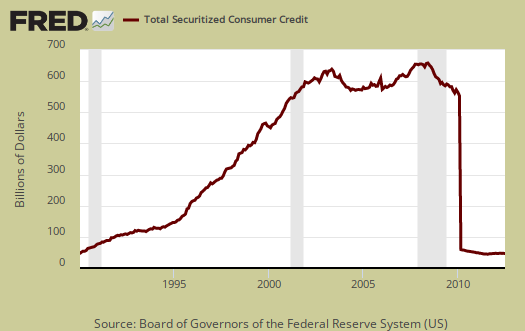

Now below is the pools of securitized assets, which dropped by $400 million to $28.5 billion. This is part of revolving credit and the Fed describes this category as:

Outstanding balances of pools upon which securities have been issued; these balances are no longer carried on the balance sheets of the loan originators.

The shift of consumer credit from pools of securitized assets to other categories is largely due to financial institutions' implementation of the FAS 166/167 accounting rules.

We're not sure exactly what this means but clearly these derivatives were wiped out during the great recession. They are off-balance-sheet securitized assets originated by all major holders.

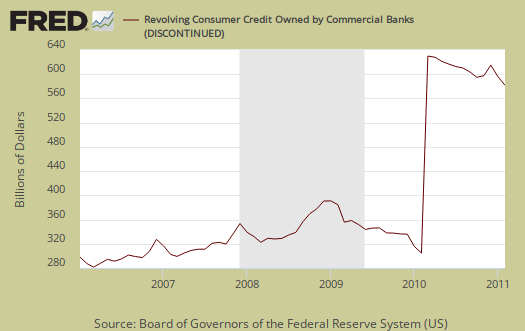

Below is commercial banks and magically there revolving consumer credit ballooned about the same time as securities pools plummeted, which we believe was caused by a change in FASB accounting and guidance rules for off book credit and risk.

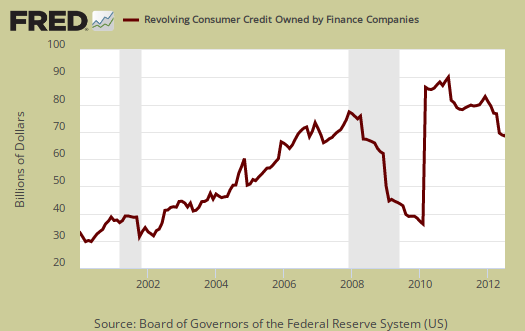

So, in terms of real revolving consumer credit, we're not so sure the July reported drop, in terms of what's really available to regular consumers, is a drop, since the majority is in these pools of securitized assets. Below is revolving credit by finance companies, which did decline $200 million from June.

Here again we see that correlating cliff to pools of assets and we can only assume these pools of securities assets are off the corporate books derivatives. They are being brought back onto the liabilities book, we think, via FSAB accounting rules changes in 2010. That said, they are the cause of this month's revolving credit decline, so what does that mean, real credit also declined? We're digging around to understand this gray matter in the consumer credit report and when we get some answers, we'll update this post.

Bottom line, we are a debt society. Instead of looking at this as debt, economists look at it as money in the economy people can then spend. Looser credit might also imply people are more credit worthy, but these days student debt is more debtors prison. People don't go into more debt unless they have to, although offering up more debt implies banks think people can pay it back. Students who have reasonable tuition and can get part-time jobs don't go into absurdly high debt. Parents who have careers and savings to help their kids pay for college don't go into debt either. Most importantly, people with good incomes do not go into debt. The focus on credit instead of income and wages is just another sign of how wrong headed our economic focus is.

Recent comments