"Once a run gets started it is rational for other people to join in.”

- Mervyn King, Governor of the Bank of England, commenting on bank runs

Probably about now the people who actually wanted the massive bailout of the Wall Street crooks are asking themselves, "What exactly did we buy with the $700 Billion in taxpayer money?"

It's a little late to ask that question You don't purchase a car without kicking the tires, you don't purchase a home without having the foundation inspected, and you don't bail out Wall Street unless you made certain that the money isn't going to be wasted.

With the DOW dropping nearly 2,300 points in just the 7 days since the bailout was announced, the sheeple are realizing that they've been mugged by the crooks yet again. Except this time the taxpayer wasn't held up. We gave them our wallets willingly.

Now here's the kicker:

That $700 Billion is only the downpayment. The real payments are already happening and Congress didn't vote on it.

How much is this going to cost all of us? More than you can possibly imagine.

The global financial crisis is turning into a bigger drain on the U.S. federal budget than experts estimated two weeks ago, ballooning the deficit toward $2 trillion.

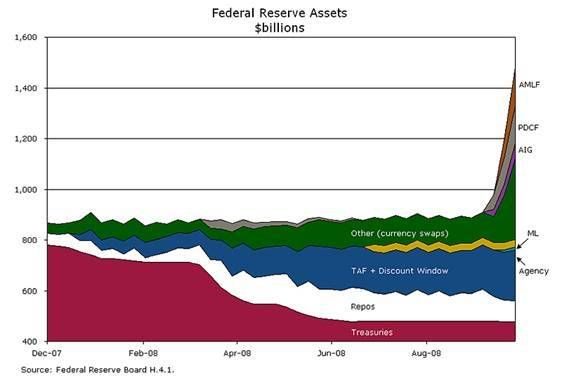

Bailouts of American International Group, Fannie Mae and Freddie Mac likely will be more expensive than expected. States are turning to Washington for fiscal help. The Federal Reserve said this week it will begin buying commercial paper, the short- term loans companies used to conduct day-to-day business, further increasing costs. And analysts now say the $700 billion bank- rescue plan passed by Congress last week may have to be significantly larger.

Can you even imagine a $2 Trillion yearly deficit? To put this into perspective, this country has accumulated just over a $10 Trillion in 230 years. Now we'll be adding 20% to that in a single year, and then do it again next year. Where is all that money going to come from in a country with no savings?

We could borrow from foreigners, right? Our Asian creditors do have massive currency reserves, but those currency reserves are already invested in our dollar-based debt. If they sell our corporate debt or equities to buy our treasuries then we simply move the problem from one place to another.

Besides, foreigners are also engaging in massive bailouts to save their own economies from what the IMF just called a "global meltdown", so they are going to need what savings they have. From Pakistan to Iceland, nations all over the world are about to go bankrupt, and there doesn't seem to be anything the authorities can do about it.

It is the ultimate fallacy of the bailout. $700 billion is a drop in the ocean. They can’t print money fast enough.

And print money they will. The Federal Reserve is currently engaging in an unprecedented expansion of both the money supply and its influence in the economy. The most obvious example of this is the Fed becoming the creditor of last resort, and directly lending to companies.

The central bank invoked emergency powers to lend money to companies outside the financial sector and buy up mounds of commercial paper, the short-term debt that firms use to pay for everyday expenses like salaries and supplies.

Has anyone stepped back and asked the obvious question of what it means when just about every corporation in the country owes money to a government agency?

Another question no one is asking is just how large the problem is? No one knows for certain because the credit problem is now global and infecting every area of the financial economy, but you can draw a few conclusions.

Of the 25 companies I studied, their total assets were $14.6 Trillion, Level 1 assets were a total of $1.3 Trillion, Level 3 assets were only $802 Billion but Level 2 Assets were $7.3 TRILLION!Are you kidding me! 50% of the group’s total assets were Level 2 “assets that aren’t actively traded, but have quoted market prices for similar instruments - otherwise known as ‘mark to model.”

I don't need to mention that those "models" are now broken.

Comments

I don't know how you managed

to get me to laugh while reporting on such dismal numbers but those images are outstanding!

New Deal Democrat wrote Silver Lining, which shows the temporary fix before the reality that they are printing money and blasting out the deficit hits.

Goldman Sachs, JP Morgan, Citigroup

The favored ones.....news on Paulson meeting with these CEOs to finalize his comprehensive financial crisis plan.

Something is needed to dig further into this but it sure seems a small select financial group are the ones targeted to be kept afloat. Nice to have friends in Washington.